Table of Contents

The historical and modern concept of the Family Office

The origins of the Family Office can in part be traced back to the 6th century. At that time the so-called “majordomo” (lat. maior domus – ‘chief of the house’) performed the developing function of being in charge of the domestic service and smooth functioning of the sovereign’s household. The modern concept of Family Office as we know it today dates rather from the beginning of the 19th century.

It was in 1838 that the financier John Pierpont Morgan founded the House of Morgan that henceforth managed the wealth of his family. Some fifty years later, the famous Rockefeller family created its own Family Office in order to preserve its assets and to manage the family’s philanthropic activities.

While the first Family Offices dealt with the management of assets of one single family (known as Single Family Offices), their relatively high operational costs led quite a number of families to offer these services to other wealthy families. This gave birth to a new category of service providers – the Multi Family Offices.

The spectrum of services offered by both Single and Multi Family Offices is extremely broad and always in accordance with the needs of each family. The classic and essential task of a Family Office is to protect, preserve and develop the wealth of a family in the long term and support continuity of excellence and growth across generations.

The Family Office and Luxembourg – a perfect fit

In its continual and successful efforts to maintain the status of Luxembourg as not only the number one investment centre in the EU and not only the second largest investment fund centre in the world (only after the US) but simultaneously a globally renowned private wealth management destination even and especially in the uncertain post-2008 environment, the Luxembourgish government has recently passed a law establishing the legal framework for Family Offices in Luxembourg.

With an increasing rate of global capital mobility and globalization accompanied by corresponding market integration and the broadening and deepening of the international profile of High Net Worth Individuals and their families, there is a strong and growing need for a wealth management facilitator aimed at centralising all the numerous financial operations of families with diverse cross-border relations.

Keeping an overview of internationalised assets that are subject to diverse legal and fiscal regulations and complex inheritance rules is a real challenge and a heavy burden on modern success. Therefore, the need for professional, personalised assistance that goes beyond traditional asset management is growing exponentially.

At the same time, clients with significant diversified holdings require a greater degree of independence from their advisers with respect to service providers and suppliers of investment products. This is precisely one of the core mandates of the Family Office – long-term loyalty to the client family and to seeking the best possible solutions to its investment needs, interests and goals.

The Family Office Act regulating family office activities in Luxembourg came into effect on 21 December 2012. Only the United States of America and the Emirate of Dubai have regulation to a greater or lesser extent whereas in most countries, neither the activity nor the designation of Family Office is regulated. Hence, the Luxembourg Family Office Act represents a precise specific and coordinated legal framework for Family Office activity and as such, is among the first of its kind worldwide.

Luxembourg Family Office Setup

Credit institutions, Investment advisors, Wealth managers, Specialised Financial Sector Professionals (PSF) approved as domiciliation agents, Specialised PSFs approved to carry out services such as the incorporation or management of companies, Lawyers, Notaries, Accountants (e.g. Réviseur d’Entreprises) and Auditors – all of which are regulated professions – may begin exercising Family Office activities without any additional approval.

All other service providers who exercise the activity of Family Office as defined in the law have to obtain special approval from the supervisory authority of the financial sector (Commission de Surveillance du Secteur Financier – CSSF) with a Family Office specialisation. Those already set up in Luxembourg at the time the law comes into force and who already exercise the activity of Family Office without exercising one of the above professions have a six-month grandfathering period from the date of the law’s coming into force to conform with its provisions.

Approval is reserved to legal persons who have a corporate capital of at least €50,000. To obtain approval, the shareholders and management of the company must prove their professional standing, which the CSSF assesses on the basis of their past history, criminal records and any other elements which show good reputation and present every guarantee of irreproachable business conduct.

The Family Office designates two directors who will be answerable to the CSSF. An external auditor must certify the accounts. Furthermore, the central administration of the Family Office must be located in Luxembourg.

In terms of set up, the most important innovation of the law is the creation of a new Professional of the Financial Sector (PSF) specialised as a Family Office. If not already approved as a Family Office, any eligible service provider may apply for this dedicated PSF status and register with the CSSF.

Key features of Luxembourg Family Offices

- Family Offices may directly be involved in wealth management or can limit themselves to selecting specialist external service providers – bankers, investment advisers, asset managers, insurers, lawyers and realtors – and co-ordinating and supervising the services of these providers.

- Together with wealth management and reporting services, the activities of a Family Office can include the development of an investment and asset allocation strategy, wealth structuring, inheritance planning and risk management.

- A Family Office can work for a family in the creation of an art collection or in the creation and management of a philanthropic foundation. It can offer secretarial, custodial, relocation, or headhunting services and some can provide financial education to the younger generation.

- The Luxembourg regulation is aimed exclusively at Multi-Family Offices. Therefore Single-Family Offices created by one family or supporting one family do not fall within the scope of the law. The law is aimed uniquely at professional advice and services related to wealth management and structuring such as estate planning and administration, the co-ordination of service providers and the follow up or evaluation of their performance.

- Activities relative to non-financial assets such as the management of buildings or art / precious objects collections are not subject to regulation. Other activities that are not regulated within the framework of the law are family estate management arrangements that take the form of other legal entities. Such arrangements include the role of company agent, board member of a foundation, trustee, fiduciary agent or court appointed official.

- As for any Luxembourg credit institution, every person exercising the activity of Family Office is subject to professional confidentiality and is obliged to keep confidential all information that is entrusted to him/her within the framework of his/her professional activity.

- The Family Office must respect the provisions of legislation against money laundering and the financing of terrorism which oblige it to check the identity of its client and, where appropriate, the beneficial owner of the assets, before entering into a business relationship or executing a transaction for that client. Failure to respect this can result in a penalty of up to five years in prison and/or a fine of €125,000.

- Family Office service providers must be fully transparent with regard to their direct and indirect remuneration, including any rebates obtained in the management of a client’s assets.

Advantages for Family Offices in Luxembourg

- Tax management of repatriation to investors via conversion of financial flows.

- Consideration of estate planning and governance matters.

- Relocation of on-shore structuring into one country: greater stability, less red tape, improved communication between stakeholders.

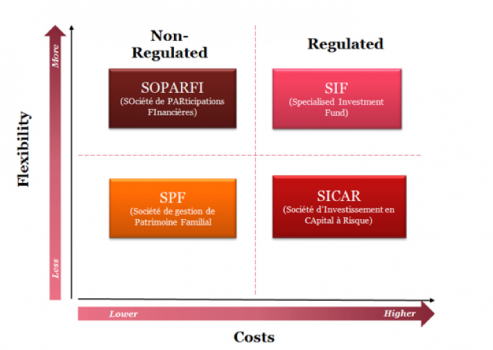

- One country with a wide range of (regulated / non-regulated) solutions complying with the objectives of the individuals.

Different possible structures

Family Offices in Germany

Legal structures

Family offices may be structured in various ways in Germany. Normally, it would be advisable to establish an independent legal entity using a corporation (stock corporation — AG, limited liability company — GmbH) or a limited liability partnership (KG). The use of a partnership (without built-in limitation of liability) does not seem appropriate (but is also possible). From the point of view of corporate law, corporations (especially stock corporations) do not offer the same degree of flexibility as limited liability partnerships. But this effect is — more or less — limited to corporate matters, such as notarization of the articles of association and their amendments and (in case of stock corporations) notarization of other shareholder meetings. In view of the daily business there are no real differences between the relevant structures.

Limited liability company

A limited liability company (GmbH) requires a minimum share capital of €25,000. The GmbH is represented by its managing directors (Geschäftsführer) who are (only) internally bound to shareholder decisions, but can act independently, against explicit shareholder instructions, with legally binding effect.

Stock corporations

Stock corporations require a minimum share capital of €50,000. They are represented by their executive directors (Vorstand) who can also act independently. The executive directors are chosen by the supervisory board (Aufsichtsrat) whose members are elected by the shareholders. A direct supervision of the executive directors by the shareholders is legally not possible.

Limited liability partnership

The limited liability partnership is normally composed of a GmbH acting as a general partner, and one or more limited partners whose liability can be limited to any amount (but must be registered with the commercial register of the company). The partnership is managed by the general partner (that which is a GmbH by its managing directors). One or more limited partners may be managing directors of the GmbH (general partner). In view of the general partner’s power of attorney the same rules apply as for the GmbH. It should also be mentioned that German law does not have structures comparable to common law trusts. The distinction between legal title and equitable ownership is totally alien to the German legal system.

Tax issues

From a tax point of view, the treatment of corporations and partnerships is totally different, at least regarding the taxation of profits. Corporations are (as such) subject to corporate tax (Körperschaftsteuer, 15%) and solidary surcharge (Solidaritätszuschlag, 5.5% on the corporate tax). Furthermore, trade tax (Gewerbesteuer, approximately 20% depending on the location of the business) is imposed on the company.

If a family office is set up as a corporation and actually holds the family assets, certain parts of the income (dividends and capital gains from the sale of shares in corporations) are nearly totally tax-exempt (only 5% of such income is deemed to be non-deductable expenses). This can lead to material economic savings. If, however, the profits of the family office get distributed to its shareholders (individuals) this again may be subject to German income tax (and solidarity surcharge) if such shareholders are taxable in Germany. Normally a flat tax on 25% of the dividends is applicable.

Partnerships are not subject to corporate tax. Their income is split among the partners (without regard to whether or not a profit distribution is actually made) and taxed as their personal income. Such income of the partners is subject to income tax (Einkommensteuer), if the partner is an individual, or corporate tax, if the partner is a corporation. Dividend income and capital gains of the partnership may be partially tax-exempt; in this regard special rulings may apply (partially depending on the shareholder structure).

Additionally, a partnership can be subject to trade tax if it qualifies as a business establishment rather than an asset manager. To the extent individuals participate in the partnership, part of the trade tax paid by the partnership may be credited to their personal income taxes.

Family Offices in Switzerland

Due to Switzerland’s federal system, taxes are levied on three different levels, the federal, cantonal and communal level. Therefore, the taxation of similar legal structures varies from canton to canton as some of the applicable regulations, and in particular tax rates, are not harmonised.

In general, corporate taxation for family offices in Switzerland consists of the following aspects: Corporate income tax is levied at the federal, cantonal and communal level. Whereas the federal statutory tax rate is 8.5% of the net profit after tax, the cantonal and communal rates vary depending on the location of the entity and the tax privileges available, if any. In case of ordinary taxation, the total effective maximum tax burden, consisting of federal, cantonal and communal taxes, ranges from approximately 12% to 25%. Provided a tax privilege is applicable, total effective maximum tax burden starts at approximately 8%. Capital tax on net equity is also due once a year and varies, as it is levied on the cantonal and communal level only, between 0.001% and 0.525% depending on the location of the entity and the tax privileges available, if any. Approximately half of the cantons foresee that the corporate income tax can be credited against the net equity tax.

Usually, family offices provide their services mainly to related parties in a closed environment. In order to avoid discussions with the tax authorities on the taxable profit, family offices should either prepare sufficient documentation on their transfer prices or reach a respective agreement with the authorities in an advance tax ruling. Such a ruling would generally define the taxable profit based on the cost-plus method, with a markup between 5% and 15%, depending on the value added of the operations in Switzerland.

In some specific circumstances, and providing certain prerequisites are fulfilled, it might be possible to benefit from tax privileges by establishing the family office either as a so-called domiciliary company, which is based in Switzerland only for administration purposes, without operating any kind of ordinary business, or as a mixed company that conducts its main business abroad with only rather marginal operations in Switzerland.

A one-time capital duty of 1% is generally levied on capital increases or contributions to Swiss incorporated companies. However, tax planning is available around exemptions for (i) qualifying mergers, reorganizations and financial restructurings and (ii) other contributions within incorporations and capital increases up to the first CHF 1 million. In addition, a securities turnover tax on the sale or exchange of taxable securities may apply if: (i) the family office qualifies as a securities dealer in the capacity of a broker or dealer or (ii) trades on the family office’s own account, provided it holds more than CHF 10 million of taxable securities. The tax rate is 0.15% for Swiss securities and 0.3% for foreign securities.

Economic double taxation, such as taxation of the corporation and the taxation of the shareholder, according to his or her distribution, should also be considered. But it may be reduced or avoided by mitigating provisions similar to the partial taxation of dividends distributed to Swiss residents or the participation exemption applicable to Swiss corporate shareholders, provided they hold in both structures a minimum share of 10% in the family office. For the participation exemption, an alternative fair market value of the participation of a minimum of CHF 1 million is sufficient.

Family Offices in Austria

The legal form of a family office in Austria is mainly defined by the family’s wealth structure. Complex structures and assets have to be permanently monitored, controlled and managed, whereas less complex structured assets may require less monitoring, but focus more on asset protection and preservation for future generations. Depending on the family’s wealth structure, a family office’s functions range from mere administration to high level advice and management services.

Depending on the family’s asset structure, the Austrian jurisdiction offers different suitable legal forms. Since the introduction of the Austrian Private Foundation Act in the 1990s, many family-owned fortunes were endowed in private foundations. Accordingly, many organizational and administrative services are provided by the Foundations Governing Board. Today, the governing board does not only manage and coordinate family assets, but also needs expertise in other fields and should guarantee independent, complete and comprehensive advice. Although the Foundations Governing Board is not considered the management board of the Private Foundation by the Austrian Private Foundation Act, a family office can be installed through the Foundations Deed. The family office’s members, tasks, functions, rights and goals, as well as the governing board’s instruction rights can be established in the foundations deed.

Outside the legal form of the Austrian Private Foundation, a family office can be set up as the managing board of a holding company with limited liability (GmbH), which actually holds the family’s assets, or as a service company with limited liability that offers advisory services to the family’s holding companies or the family members themselves. However, from a tax planning perspective, family offices in other legal forms, such as partnerships, can be attractive in Austria, depending on the asset and holding structure and the range and kind of services provided by the family office.

Family Offices in UK

Legal structures

It is possible to set up a family office in the UK using any of the following structures:

- Limited company

A limited company is a corporate entity limited by shares. The family may be the shareholders and possibly also act as directors, with or without non-family professionals at the family office. A company has separate legal personality. - Partnerships

A partnership is two or more persons carrying on a business with a view to profit. It is effectively transparent for tax purposes (i.e., the partners are taxed on their share of the income and gains of the partnership). A limited partnership has “general partners” who manage the partnership, and “limited partners” with limited liability who do not. A Limited Liability Partnership (LLP) is an entity that is taxed in the same way as a partnership, while affording limited liability to its members. - A trust

A trust is an arrangement whereby assets are held by trustees for the benefit of the trust’s beneficiaries. They are generally governed by a trust deed. - Informal or contractual relationship

Families may employ individuals directly to provide them with family office services. Alternatively, there may be an informal arrangement whereby individuals who are employed by the family company also provide family office services to the family.

Tax structures

UK-resident limited companies are legally distinct entities and are subject to corporation tax on their profits. Non UK-resident companies are not subject to corporation tax unless they carry out business in the UK through a “permanent establishment.” If they receive income from a UK source otherwise than via a permanent establishment (e.g., from UK property or other UK investments), they may be subject to income tax.

Partnerships, limited partnerships and LLPs are generally transparent for tax purposes, and the partners are taxed directly on their share of the income and gains. The trustees of UK resident trusts are subject to income tax and capital gains tax on the income and gains of the trust. Non-UK resident trusts are subject to UK income tax on UK source income. Anti-avoidance provisions can apply to tax income and gains received by non-UK trusts, companies and other entities on UK residents connected with the entity. This is a complex area and advice should be taken before establishing a non-resident entity. However, offshore entities can provide tax advantages in certain situations, particularly in respect of family members who are non-UK resident or non-UK domiciled.

Where payment is made for family office services under a contractual or informal arrangement, the recipient may be subject to tax on the income. The precise tax treatment will depend on the specific circumstances of the case.

Family Offices in U.S.

U.S. taxation of individuals and trusts

The taxable income of US citizens, tax residents and domestic trusts is subject to a graduated rate schedule. The top marginal tax rate on the ordinary income of individuals and trusts is 39.6%. Long-term capital gains and qualified dividends are taxed at a top income tax rate of 20%. In some cases, the Alternative Minimum Tax (AMT) may apply. AMT has a top marginal rate of 28% and applies when it exceeds the regular income tax of an individual or trust.

US taxation of partnerships

Partnerships are not subject to federal taxation at the entity level. Instead, the partnership allocates its items of income, deduction and credit to its partners. Allocations of items of taxable income and deduction may be in accordance with capital ownership percentages, but need not be so; partnership taxation generally offers flexibility in allocations so long as the allocations are specified in the operating agreement and reflect the partners’ economic interests in the partnership.

US taxation of corporations

Corporations are generally subject to US income tax at the entity level on their worldwide income, with a credit allowable for certain taxes paid to foreign jurisdictions. The maximum federal corporate tax rate is currently 35%. There are no preferential rates for long-term capital gains recognized by a corporation as there are for individuals. Additionally, the 3.8% net investment income tax does not apply to corporations. Corporations may deduct a portion of their dividends received, and the AMT for corporations is more punitive in its treatment of municipal bond income than it is for individuals.

Family offices housed within private operating companies

Many family offices begin within the structure of a private operating business, providing services to the family business owners. These family offices are not segregated into a separate legal entity, but rather exist as a division of the operating company itself. Operating a family office within a private operating company presents numerous additional tax issues to consider. Also, from a non-tax standpoint, housing a family office within a private company can create privacy and governance concerns, especially if significant management operations are handled by non-family members, or if family members have varying degrees of involvement in the operating company.

Private trust companies

Family offices often consider whether they should provide professional fiduciary (trustee) services to the family members they serve, or whether such services are best purchased from external sources. Those offices wanting to provide fiduciary services may consider setting themselves up as a private trust company in order to bundle fiduciary services with traditional family office services. The number of private trust companies remains a small percentage of the overall number of US family offices.